DeFi's October Crash: Is This the End, or Just a Reset?

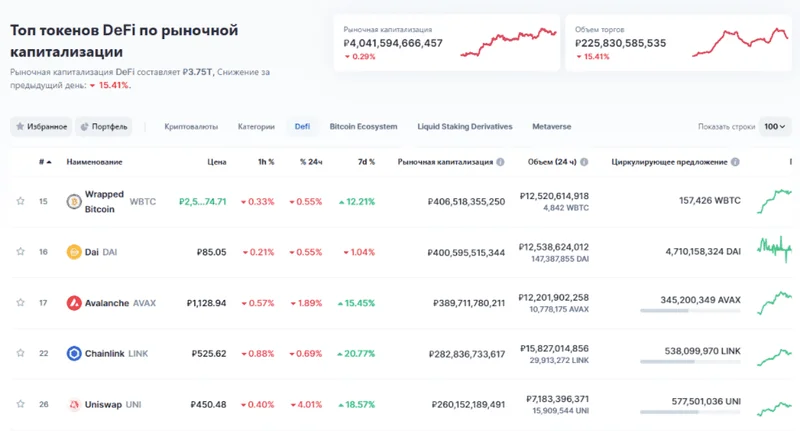

The crypto markets have been turbulent, to say the least. We all felt the tremors from October's little earthquake, and the DeFi sector, well, it's been feeling the aftershocks something fierce. FalconX's recent report paints a picture, and it's not all sunshine and rainbows. I mean, let's be real: only 2 out of 23 leading DeFi tokens are positive *this entire year*? That's… rough. And down 37% *quarter-to-date* on average? Ouch. It's like watching a house of cards in a wind tunnel. DeFi Token Performance & Investor Trends Post-October Crash | 2025 Analysis - News and Statistics - IndexBox

But here's the thing—and this is crucial—when the dust settles, something new always emerges. Always. Are we looking at a complete collapse? Absolutely not. We're seeing a *correction*, a recalibration. Think of it like pruning a rose bush. You cut back the dead and dying, and what's left grows back stronger, more vibrant. The market is doing the same thing, shedding what isn't working and paving the way for genuine innovation.

Flight to Safety: Buybacks and "Idiosyncratic Catalysts"

Investor Behavior and Market Dynamics What's fascinating is *where* the money is flowing. Investors are clearly spooked, and they're running to what they perceive as safer ground. Tokens with buybacks, like HYPE and CAKE, are seeing relatively better performance. Why? Because buybacks signal confidence, a commitment from the project to support its token. It's a vote of confidence, a life raft in a stormy sea. Then you have MORPHO and SYRUP, outperforming their lending peers thanks to, as FalconX notes, "idiosyncratic catalysts." In other words, something unique is driving demand, some specific feature or development that's capturing investor attention.DeFi's "Safe Harbors": A Quest for Sustainable Yields

The Search for Catalysts and Sustainable Yields But what *are* those catalysts? That's the million-dollar question, isn't it? Are we seeing the rise of a new breed of DeFi projects, ones that are more resilient, more innovative, and better equipped to weather the storm? It certainly seems so. And, I think, we can see investors are crowding into lending names during this selloff. I mean, it makes sense, right? Lending and yield-related activity feels more stable than the rollercoaster of trading. With everyone piling into stablecoins, the hunt for yield is only going to intensify. The real question is, are these lending platforms truly prepared for the influx, and are the yields sustainable?DeFi Platforms: Building Tomorrow's Financial Ecosystems?

The Potential for Platform-Based Innovation Consider this: the old internet was dominated by portals like Yahoo, but the future was built by platforms like Google and Facebook. What if this DeFi shakeup is clearing the way for the next generation of *platform* plays, projects that offer more than just a simple token swap or lending service? I am excited by this idea.DEX "Clearance Sale": Opportunity or Warning Sign?

DEX Performance and Valuation And, speaking of platforms, let's talk about DEXes. Spot and perpetual decentralized exchanges are seeing declining price-to-sales multiples. That sounds bad, but it also means they might be getting *cheaper*. Some, like CRV, RUNE, and CAKE, actually posted *higher* 30-day fees compared to September. So, while their valuations might be down, their actual usage is holding steady, or even growing. It's like a department store having a clearance sale – the prices are lower, but people are still buying.DeFi: Not Dead, Just Leveling Up!

Signs of Trouble and Overall Market Trends It's a complex picture, no doubt. Some DEXes, like HYPE and DYDX, are seeing their multiples compress faster than their fee generation declines. KMNO's market cap fell 13% while fees declined 34%. That's a sign of real trouble. But the overall trend suggests that DeFi isn't dead; it's just… changing. This is the kind of breakthrough that reminds me why I got into this field in the first place. When I first saw the numbers, I honestly just sat back in my chair, speechless. A Glimpse of the Next DeFi Era?DeFi's Reset Button: A Springtime Rebirth?

The Future of DeFi: Correction or New Spring? So, what does all this mean? Are we on the cusp of a DeFi winter, or are we seeing the seeds of a new spring being planted? I think it's the latter. The October crash was a painful but necessary correction. It flushed out the weak projects, exposed the unsustainable models, and forced investors to re-evaluate what they're looking for. Now, the stage is set for the next wave of DeFi innovation.DeFi's Promise: Decentralization, Security, and Accessibility for All

The Importance of Decentralization, Security, and Accessibility But with this new wave, we need to be mindful. We need to ensure that these new platforms are truly decentralized, that they're secure, and that they're accessible to everyone. The promise of DeFi is to democratize finance, to empower individuals, and to create a more equitable system. We can't lose sight of that. The Phoenix is Rising